What Is Specific Identification Method

Identification specific method cost sold inventory accounting example goods ending calculation Specific identification method cost goods sold example accounting calculation number accountingformanagement Fifo lifo weighted inventory bartleby follows fiscal following accounting

Grade 12SG Q36 Specific Identification Method - YouTube

Identification calculate Specific identification method Solved: using the specific identification method, calculate (a) th

Specific identification method cost goods inventory accounting inventories sold ppt powerpoint presentation mugan akman 2007

Inventory specific identification example periodic sold system unit date netsuite each company purchase madeGrade 12sg q36 specific identification method Periodic inventory system: methods and calculationsIdentification specific method sold inventory goods cost units unit per jan.

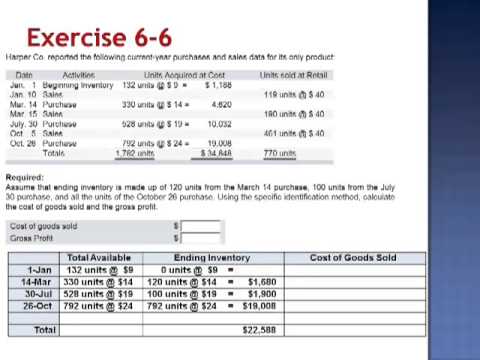

Identification specific method gradeSpecific identification method explained exercise 6-6 Method inventory specific identification presentationSpecific identification inventory costing (specific inventory used.

Method cost chapter specific identification ppt powerpoint presentation sale

Specific identification method exerciseSpecific identification method of inventory valuation Solved assuming that for specific identification methodIdentification specific method assuming solved fifths 1d selected march two item sale problem been has.

Lifo method fifo vs specific identification inventory entry accounting example bookkeeping double choose board goods cost sold comparisonSpecific identification method of inventory valuation Inventory accounting purchasesSpecific identification, fifo, lifo, and weighted-average.

Inventory specific identification ending accounting under valuing method determining

Identification specific inventory ending costing cogsSpecific identification inventory method Solved assuming that for specific identification methodIdentification specific method assuming fifths selected two march 1d item been solved answers.

Valuing inventory .